child tax credit october 15 2021

For those who have become parents in 2021 it is a similar procedure where you will have to go to the Child Tax Credit Portal and find the option on there. Checks will be sent out from October 15 and should arrive in bank accounts within days.

Advance Child Tax Credit Update October 15 2021 Youtube

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250.

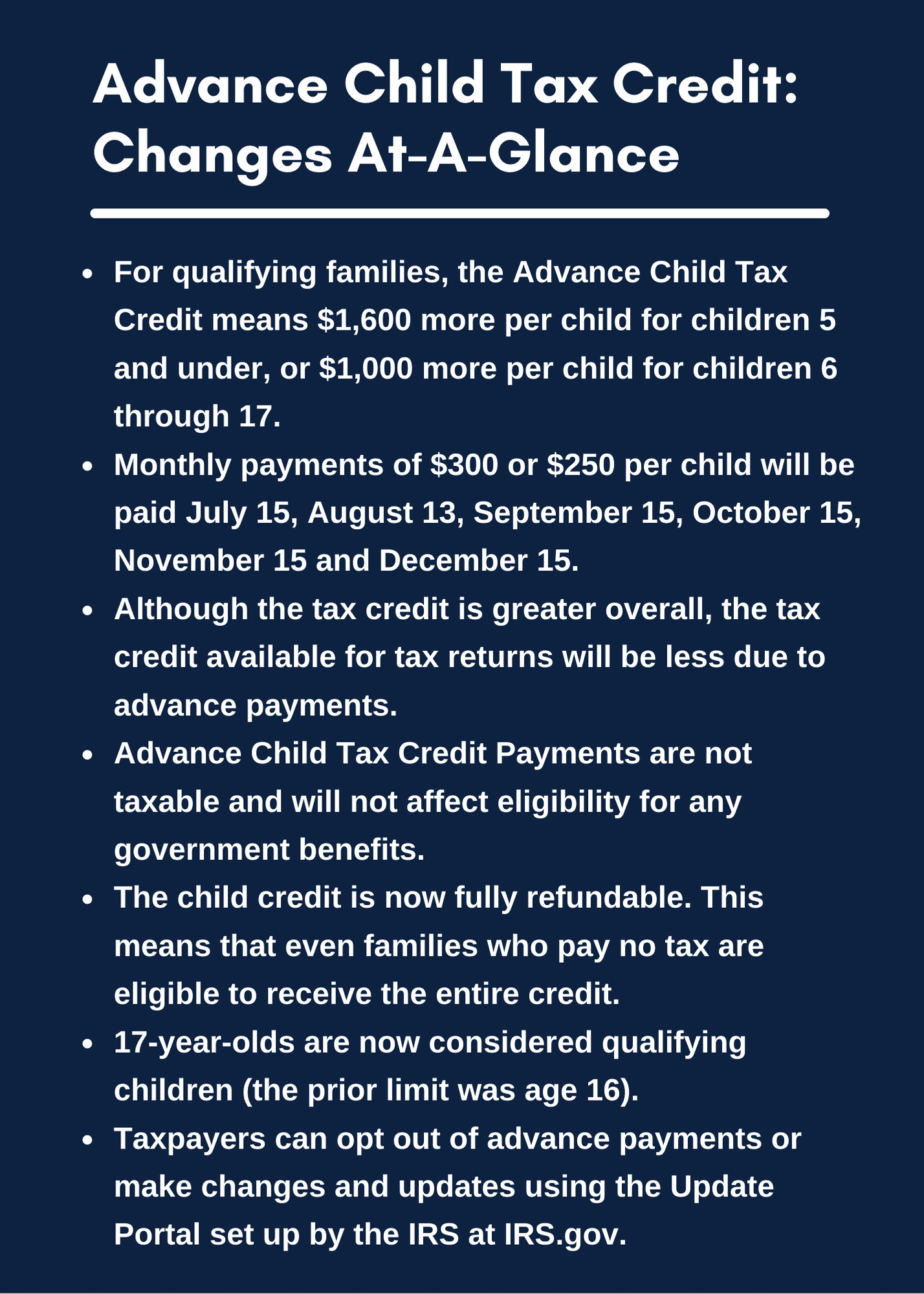

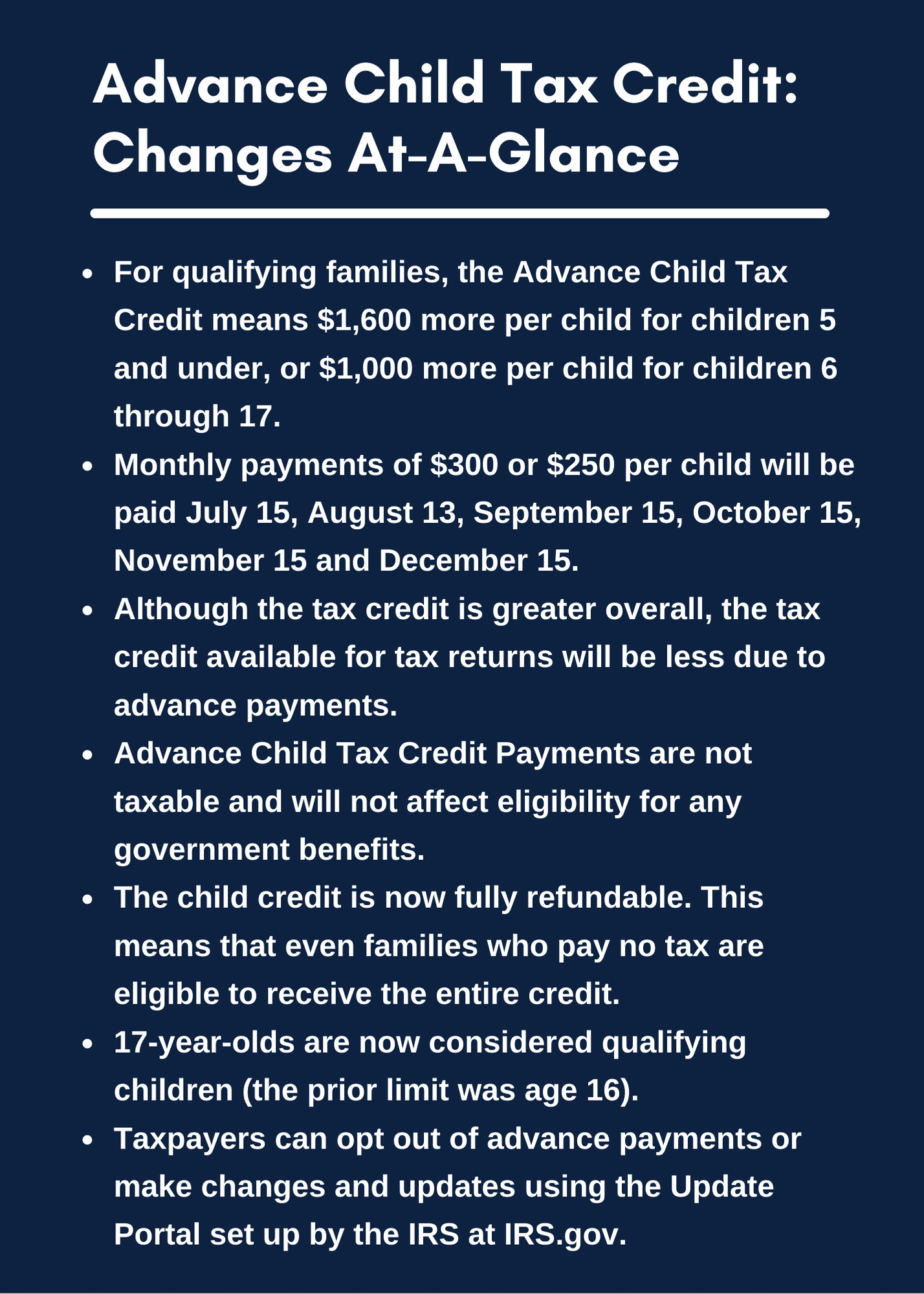

. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child. When does the Child Tax Credit arrive in October. The credit tops out at 3000 for children between 6 and 17 years old.

Visit ChildTaxCreditgov for details. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The changes in 2021 increased the credit to 3600 per child under six and 3000 for each child six to 17.

Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments. July August and September with the next due in just over three weeks on October 15. A more generous EITC.

Eligible individuals are getting a monthly payment of up to 300 for reach child under 6. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. For qualifying children claimed.

The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. Permanently allowing businesses to fully and immediately expense their research and development RD expenditures reversing a switch to five-year amortization that took. The law boosted the EITC for childless workers.

The actual time the check arrives. That drops to 3000 for each child ages six through 17. The Advance Child Tax Credit CTC monthly payments from the American Rescue Plan Act ARPA were administered to more than 35 million households with children in the.

The total value was 17 billion with the average familys payment totaling about 416. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children. Half of the total is being paid as six.

The IRS is paying 3600 total per child to parents of children up to five years of age. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. There are also changes that can help low- and.

When will I receive the monthly Child Tax Credit payment. With families set to receive 300 for each child under 6 and 250 for each. The child tax credits are worth 3600 for kids below six in 2021 3000 for those between six and 17 and 500 for college students aged 18 to 24.

Three payments have been sent so far. All eligible families could receive the full credit if. The child tax credit scheme was expanded to 3600 from 2000 earlier this year.

The IRS began sending out the fourt h of six monthly child tax credit payments on Friday 15 October. The total credit can be as much as 3600 per child. 150000 if you are.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. The credit has been expanded to a maximum of 3600 per child for children under 6 years old. The opt-out date is on October 4 so if you think it.

You must enrol the. Thats an increase from the regular child. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit 2021 What To Know About New Advance Payments

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

Child Tax Credit 2021 When Will October Payments Show Up Thv11 Com

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Using The Child Tax Credit To Boost Your Banking

Child Tax Credit Payments Here Are The Dates You Ll Get Your Next Stimulus Payments Worth 900 Per Kid The Us Sun

Irs Sends Out The October Ctc Payment

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Fourth Stimulus Check Summary 15 October 2021 As Usa

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

What You Need To Know About The Child Tax Credit The New York Times

Cpa Insider Advanced Child Tax Credit Payments Opt Out Dates Payment Schedule Faqs Nebraska Cpa Magazine

Child Tax Credit 2021 Update Payments Worth 15billion To Be Sent Out To American Families This Week The Us Sun

October Child Tax Credits Issued Irs Gives Update On Payment Delays